Today, we introduce the Flipboard Finance Collective, the newest addition to our Interest Collectives developed in collaboration with publisher partners such as Moneywise, TheStreet and The Points Guy. The Finance Collective brings together audiences with a demonstrated interest in personal finance both on and off platform, giving brands an opportunity to reach finance enthusiasts at scale for maximum impact and resonance.

Flipboard’s Interest Collectives integrate quality content from Flipboard curators, creators, email newsletters and publisher partner sites, creating access to high-intent audiences across key verticals including travel, tech, and now finance. For instance, while the Travel Collective is tailored to reach avid travel enthusiasts, the Finance Collective caters to savvy readers searching for news and information on fiscal policy, market trends, wealth management and more. By harnessing the collective power of contextually relevant content, brands can expand their reach considerably and present brand messaging to receptive audiences with proven affinity for financial topics.

Rising Economic Concerns Boost #PersonalFinance Engagement on Flipboard

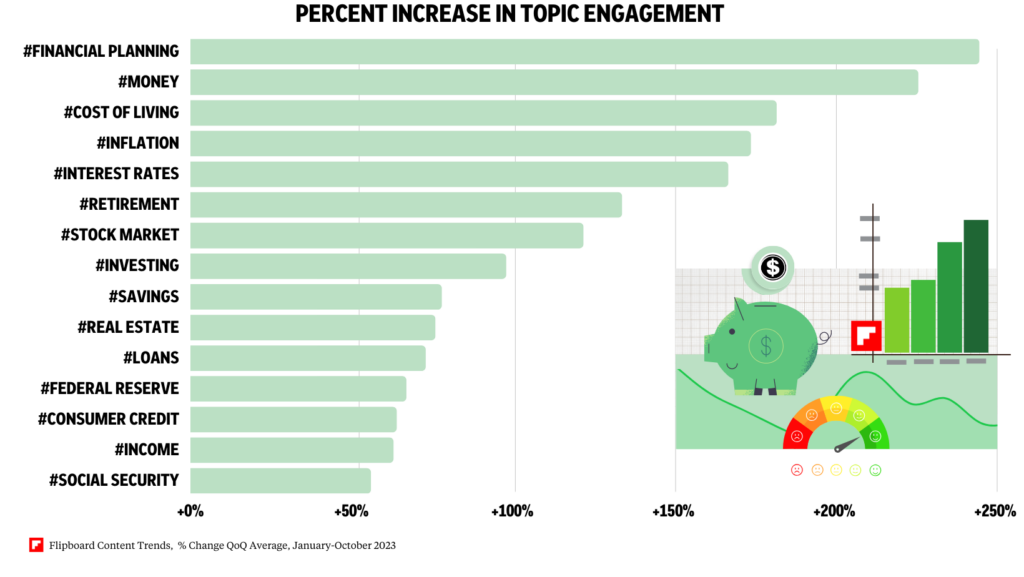

2023 has proven to be a rather tumultuous period for the U.S. economy, from rising inflation and interest rates to above-trend growth in GDP alongside much talk about a recession. Navigating the realms of investment and financial management has become increasingly complex. As a result, #PersonalFinance has emerged as one of the top trending topics on Flipboard this year, with over 145 million clicks to finance content so far.

Regardless of one’s stage in life, financial matters are likely top of mind. This is why we have prioritized providing our audience with the most relevant and reliable personal finance insights from our network of established publishers and financial experts. From helping readers make informed investment decisions to keeping them up to date on market trends and how to secure financial stability for retirement, Flipboard’s media partners and editorial team are focused on providing actionable personal finance advice for navigating a complex and evolving financial landscape.

As the U.S. financial market continues to shift, Flipboard is here to help people make informed decisions and stay ahead of the game. Simultaneously, our Finance Collective will help brands connect with high-intent audiences seeking personal finance information and advice.

—Anya Cekauskas, product marketing, is reading The Beautiful Bucket List